Ramser Development Company Q3 Newsletter

Come writers and critics

Who prophesize with your pen

And keep your eyes wide

The chance won't come again

And don't speak too soon

For the wheel's still in spin

And there's no tellin' who

That it's namin'

For the loser now

Will be later to win

For the times they are a-changin'

- Bob Dylan

One common misconception that poses a significant risk to any investment thesis is the confusion between the terms "simple" and "easy." To illustrate, consider the act of weightlifting. While the concept of lifting a set amount of weight is simple, the ease with which one can lift a 300-pound weight is a different matter entirely.

Similarly, the real estate private equity (REPE) model is fairly simple:

- Purchase an underperforming asset with potential for growth.

- Reposition the asset with capital improvements.

- Stabilize the asset, aiming for a yield roughly 200 basis points above the market capitalization rate.

- Sell the asset to another buyer, ideally achieving a 2x equity multiple and an internal rate of return (IRR) in the high teens to low twenties over a three to five-year period.

- Repeat the process.

Though this model is simple in design, its execution isn't necessarily easy. The success of the REPE model can be largely influenced by market conditions. Those of us who have weathered multiple market cycles know this all too well.

A significant factor determining the outcome of the REPE model is the residual capitalization (cap) rate:

- Falling cap rates provide a boost. Even with subpar execution, the market can be forgiving.

- Flat cap rates are neutral. Here, the quality of execution is paramount, as there is neither assistance nor hindrance from cap rate fluctuations.

- Rising cap rates present a challenge. Perfect execution might still result in losses. Currently, the market faces this scenario.

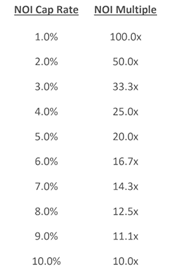

The underlying reason for this dynamic boils down to straightforward math. It's no coincidence that REPE (and private equity in general) has seen massive growth during a consistent four-decade downtrend in rates. In a world of low and decreasing rates, real estate private equity thrives. The relationship between cap rates and multiples is summarized in the chart below:

For instance, in an environment where exit cap rates are at 3%, every additional dollar of net operating income (NOI) increases the asset’s value by $33.30. However, at a 6% cap rate, that same added dollar of NOI increases the asset value by only $16.70. This 50% reduction in value growth, even with identical execution, is a significant challenge for returns, especially as the risk of economic downturn looms.

Given today's conditions, new private equity buyers should brace for lower returns. Owners of existing deals, especially those who made purchases with high-leverage, floating-rate debt and planned exits post-2023 based on 2021 cap rates, might find themselves in a substantially worse position.

However, the market still offers opportunities for those with a flexible strategy. Cash flow buyers have faced challenging conditions in recent years, but this trend is shifting. While the current environment might not be ideal for investments relying on high multiples and quick exits, it's becoming increasingly favorable for those seeking long-term yields. The catch is that securing third-party debt financing is currently challenging and expensive, to the extent that it is even available.

At Ramser Development, we are identifying more opportunities that align with our investment criteria of late. Given challenging capital markets conditions, our approach is twofold:

- Purchase with low-leverage, fixed-rate seller financing.

- Buy with no leverage and consider refinancing at a 50% loan-to-value ratio once the asset is stabilized, provided the capital markets are more amenable.

This strategy offers flexibility. If rates remain high, we are purchasing at yields that we are excited about in the long term. If rates decrease, we have the option to sell or refinance, placing us in an even stronger position.

We believe in choosing investments with a wide path to success. Given today's market, the traditional PE model offers a narrow path of leverage, aggressive revenue growth and/or cap rate compression. We’re focused on the long game: acquiring well-situated properties with minimal recurring capital expenditures and robust yield profiles.

In contrast, many larger private equity firms continue to chase high multiples and swift exits, neglecting the importance of recurring cash flow. Although we believe this approach may be misguided in this environment, it doesn't concern us. Our focus remains on delivering stable cash-on-cash returns and long-term growth for our investors.

As I write this, RDC is in the process of refinancing the RV Storage Depot Altamonte Springs bridge loan, the only floating rate debt that we have in our firm’s portfolio. While the rate is quite a bit higher than we’d like, the property’s stabilized NOI has exceeded our initial business plan by such a degree that we will still be able to achieve enough proceeds to make a distribution to investors and generate high single-digit to low double-digit cash-on-cash yields, at an LTV of just under 44%.

Once the refinance has closed, we will only have one loan maturity in the next five years, with an average portfolio LTV of below 50%. In other words, we are ready to begin more aggressively playing offense as opportunities arise as our current portfolio is structured to weather a storm, even in a recessionary scenario where NOI decreases.

We are slowly starting to see more and more attractive opportunities with stabilized yields well into the high single digits. At the same time, the debt capital markets continue to recede, meaning that RDC is either buying all-cash or utilizing seller financing. We have also begun looking at raising our own syndicated debt as a way to provide safe, low leveraged returns to investors and greater flexibility/certainly of close to RDC.

The relentless increase in long-term yields has turned investor sentiment negative and fear of losses is becoming pervasive. As such, the market has become a lot more interesting in regard to attractive potential investments. That said, it’s still early, and we are very selective in picking our spots given the opportunity costs in an environment where sellers are becoming more motivated by the day.

RDC was very conservative in deploying capital from 2020 to the first half of 2023 and firmly believe that this discipline will pay off as the return profiles in our current pipeline far exceed what we observed during that period.

Thank you for reading our second quarter newsletter. If you would like to be added to our distribution list for future investment opportunities, please visit RDC's Investor Portal.

Sincerely,

Adam Deermount

Chief Investment Officer

Ramser Development Company